Macroeconomic Overview: Multi-Speed, Uneven Growth

Global economic expansion in 2026 is expected to take place in a “multi-speed” and “uneven” environment. The AI industry has become a proven growth engine, particularly evident in the measurable expansion of capital expenditures (CapEx) and accelerated cloud revenue among tech giants. These forces are increasingly concentrating global economic momentum within a select group of countries and corporate clusters that possess both computational power and capital strength.

Unlike previous cycles where consumer demand or cyclical manufacturing led recoveries, this phase is driven by a capital-intensive growth model—centered around compute, cloud platforms, semiconductors, and infrastructure. This model is characterized by highly concentrated momentum and widening divergence between industries.

Economies capable of absorbing the AI CapEx cycle (e.g., the U.S. and parts of the Asian semiconductor supply chain) are likely to see stronger growth. In contrast, sectors or regions lacking technological investment and compute capacity may remain stuck in low-investment, low-productivity traps. This divergence is not only playing out between countries, but also between industries and individual firms. Companies with platform scale, data assets, capital market access, and high R&D intensity will continue to scale up investment and boost productivity, while firms with limited CapEx and greater reliance on external financing may be forced to delay investments in a still-high interest rate environment, further widening the competitive gap.

U.S. Macro Analysis: Growth, but Not for All

Continued Divergence in U.S. Consumer Spending

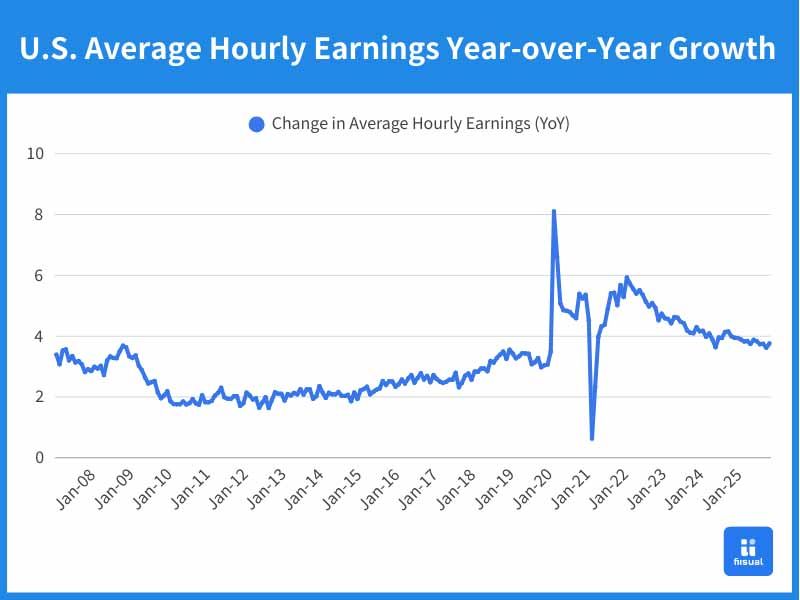

From a macro perspective, growth divergence is increasingly visible in U.S. consumer behavior. Since early 2026, U.S. consumption has continued to show a K-shaped pattern. Higher-income households are benefitting from wealth effects tied to the AI boom and maintaining elevated levels of discretionary spending. Meanwhile, middle- and lower-income groups have nearly depleted their pandemic-era excess savings and now rely primarily on wage income, making them far more sensitive to inflation and interest rate conditions.

Sticky Inflation to Pressure Disposable Income

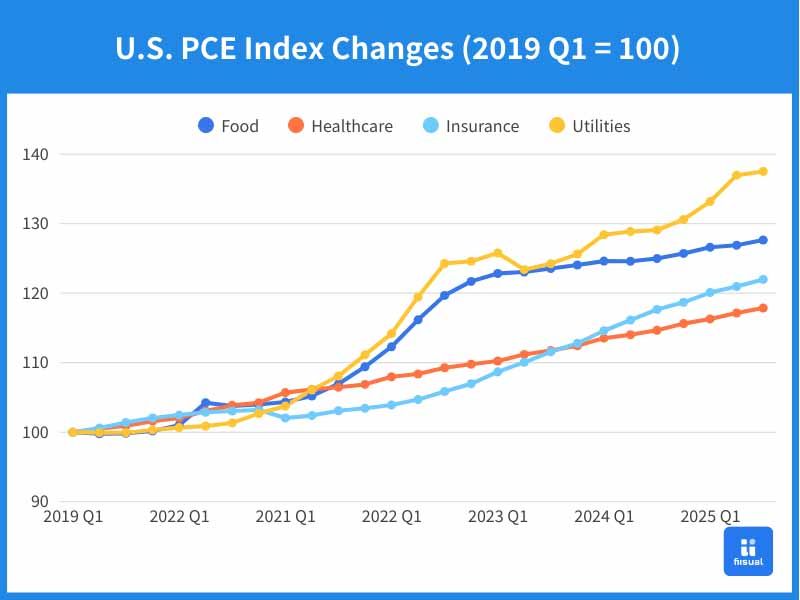

Lower-income households allocate a higher portion of their spending to categories with sticky inflation—food, healthcare, insurance, and utilities. Persistent price pressures in these areas are squeezing disposable income. While the Fed continues to describe recent inflation as transitory, we expect more costs will be passed through to consumers in 2026. As a result, sticky inflation will structurally erode purchasing power and weigh disproportionately on discretionary spending.

Labor Market Enters Structural Adjustment: Income Gap Widens

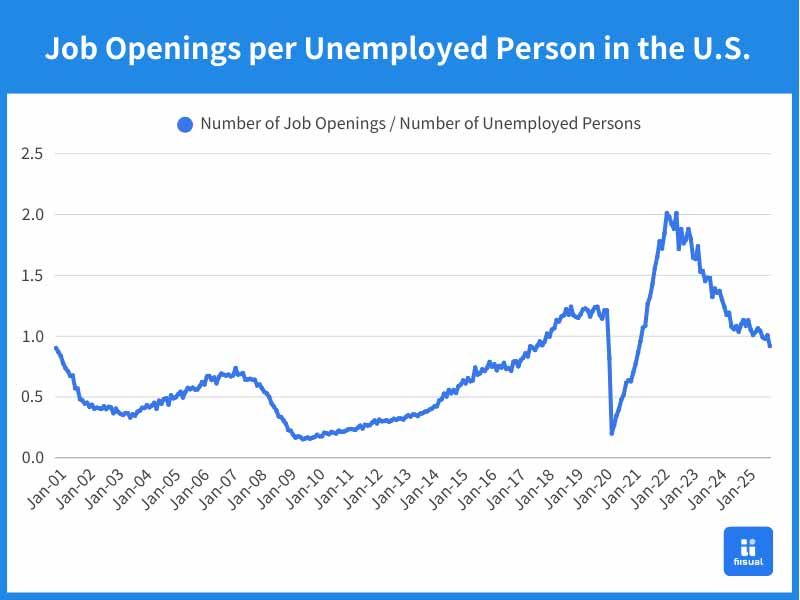

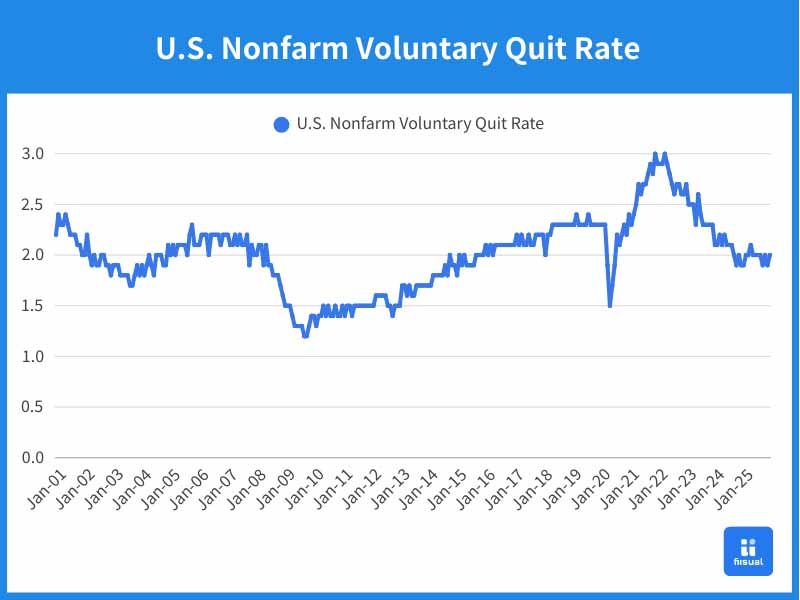

Compounding the challenge, the labor market has not improved in step with AI’s explosive growth. Instead, 2025 revealed a structural shift, as companies focused on redesigning workflows, consolidating roles, and automating tasks to drive productivity—rather than hiring en masse. This trend is unlikely to reverse significantly in 2026.

Rather than mass hiring, well-funded tech giants increasingly favor acquiring niche talent via M&A to fill specialized roles—exacerbating job market polarization. Young workers and previously resilient white-collar roles are under particular pressure, as AI adoption reduces demand for basic analysis, content creation, coding, and administrative functions. This shift has led to skills mismatch and youth unemployment, with many workers struggling to retrain or transition, leading to frictional and structural unemployment.

Related: NVIDIA Acquires Groq's Inference Technology License for $20 Billion

Meanwhile, SMEs remain cautious amid economic uncertainty, with limited capital or technical resources to implement AI effectively. This contributes to a “cold equilibrium” in the job market: low hiring by firms and few suitable openings for workers, slowing labor recovery and placing structural pressure on household consumption.

Monitoring Consumer Credit Defaults

These labor market dynamics feed directly into credit health. In Q3 2025, U.S. consumer credit delinquency stood at 4.5%, up 0.1 percentage points from the previous quarter. Credit card and auto loan delinquencies remain elevated and are trending higher. Student loan delinquencies are moderating slightly, but the share of borrowers 90+ days past due has climbed to 14%.

Mortgage delinquencies remain low, but the 90+ day past-due rate is rising, suggesting financial strain may be shifting from lower- to middle-income households. Overall, while credit defaults may not pose systemic risks for now, they are a useful leading indicator of economic stress.

Central Banks Face Narrow Policy Margins

Compared to 2025, global central banks will face significantly tighter policy constraints in 2026. In the U.S., the Fed must balance cooling labor momentum, cautious consumer sentiment, and persistent inflation—creating a policy dilemma. Cutting rates too quickly could reignite inflation, while maintaining tight conditions may deepen demand weakness.

The AI-driven labor shift complicates traditional macro indicators, blurring the lines between cyclical and structural change. While some in the market expect a dovish Fed due to political influences or appointments, we believe any policy easing will remain limited—a 25–50 bps rate cut appears a more realistic baseline. If the economy weakens significantly, more aggressive rate cuts could trigger a shift toward risk-off sentiment and downward pressure on asset prices.

Divergence in Corporate Financing Costs

Slower rate cuts mean limited downside for long-term yields, keeping valuation pressure intact. In this setting, cash-rich, investment-grade tech firms are best positioned to absorb financing costs and sustain high levels of investment, reinforcing their competitive edge.

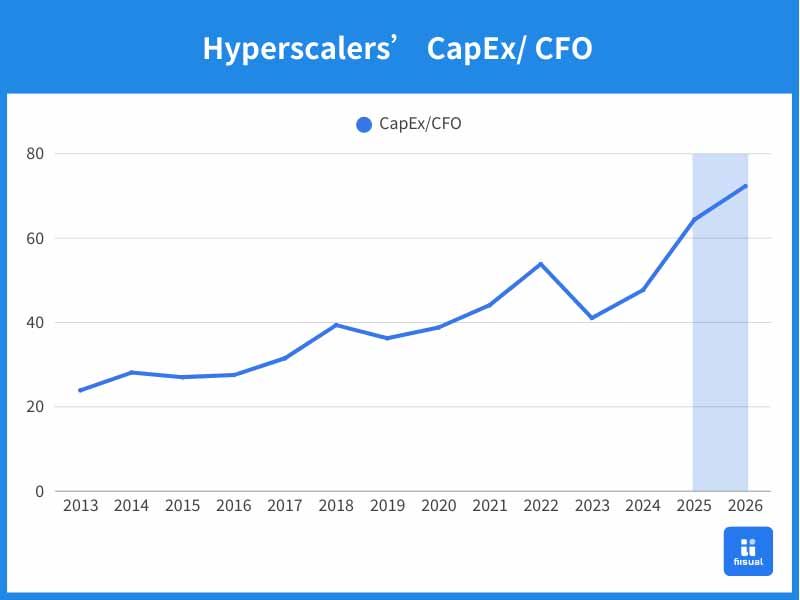

Hyperscalers, for instance, are seeing declining CapEx coverage from operating cash flows due to increasing investment scale and longer return cycles. To maintain flexibility and speed, they are tapping bond markets and private credit, diversifying funding sources and managing maturity risk.

Capital Concentration Accelerates AI Supply Centralization

As capital becomes a key differentiator, firms with strong free cash flow, investment-grade ratings, and global capital access will consolidate compute power and influence within the AI supply chain. Conversely, firms with weaker balance sheets may be forced to scale back, intensifying industry concentration and supply centralization.

Private Markets Step Up

Private credit and private equity are expected to play a growing role in AI infrastructure financing. Early-stage AI investment was dominated by venture capital, but private lenders are now stepping in with flexible funding for data centers, renewables, and M&A—offering investors attractive, low-correlation, stable returns.

Valuation Dynamics: From Multiple Expansion to Profit Delivery

U.S. Equities in 2025: Gains Highly Concentrated in AI

Despite trade policy uncertainty earlier in 2025, the S&P 500 rose ~17% from $49.69T to $58.44T. Just five cloud giants (AMZN, META, GOOGL, ORCL, MSFT) drove nearly 30% of that gain, and 12 AI leaders including NVDA contributed over 60%. Broader AI-linked stocks likely pushed this contribution even higher.

This narrow leadership compressed market breadth and concentrated index exposure within a few AI-driven names. While this amplified returns during bullish periods, it also increased downside risk and weakened the index’s ability to represent broad economic performance.

AI CapEx Now a Core Part of the Real Economy

CapEx in AI by major cloud and platform players now represents 1.2–1.3% of U.S. GDP, fueling massive demand for chips, data centers, power, networking, and cloud services. AI adoption is accelerating, with nearly 10% of U.S. firms integrating it into operations, and ~50% already paying for AI services.

We expect large-cap tech will continue to dominate the market in 2026, as they can absorb near-term cash flow pressure while benefiting from growing demand. The result: the “big get bigger” dynamic is likely to persist.

AI Bubble Inevitable, but Not Necessarily a Crash

A degree of "AI bubble" is expected, though it’s not just about soaring prices. It also reflects declining capital efficiency, extended payback periods, and temporal mismatches between spending and revenue.

Early-stage hype is tolerable to investors, but as AI hardware and infra scale, investors will demand real monetization and revenue contribution. If this fails to materialize, repricing and asset rotation may occur—likely as structural divergence, not a broad crash.

Key market concerns include:

Physical Limits to AI Infrastructure

Bottlenecks are emerging in power, land, chip supply, and data center capacity, limiting the marginal effectiveness of CapEx. Investors will focus more on ROI per dollar invested.

Circular Revenue Risk

Some fear “circular revenue” schemes, where upstream chipmakers invest in AI startups who then buy chips/services in return. Without real end-user demand, these loops could misrepresent sustainable growth and inflate valuations.

Productivity Paradox: Delayed Impact

AI's long-term productivity benefits are real, but adoption requires internal process redesign, workforce reskilling, and data restructuring—especially outside of tech. If AI merely speeds up existing workflows, valuation premiums for AI service providers may compress.

The Question is No Longer Demand, but Capital

According to Deutsche Bank, OpenAI and Anthropic are burning capital at unprecedented rates:

| Company | Time Period | Total Burn ($B) | Avg. Annual Burn ($B) |

|---|---|---|---|

| OpenAI | 2024–2029 | 140 | 80 |

| Anthropic | 2024–2027 | 200 | 66.67 |

| Uber | 2009–2022 | 300 | 23.08 |

| Tesla | 2003–2019 | 40 | 2.5 |

| Amazon | 1994–2002 | 30 | 3.75 |

While the AI growth narrative remains intact in 2026, market focus is gradually shifting from “is there demand?” to “is capital cheap enough?” and “does the funding structure introduce new credit transmission risks?”

In an environment where the pace of rate cuts is slowing and long-term yields remain under pressure, the AI investment cycle is increasingly becoming a capital-intensive race. Whether a company can maintain strong investment intensity now depends not only on product competitiveness but also on its ability to access capital markets and manage financing costs. As a result, market returns are expected to move away from beta-driven gains, with pricing in risk assets becoming more fragmented and return generation leaning more toward alpha driven by stock selection and capital structure.

Within this framework, high-quality investment targets can be screened using two verifiable financial capabilities:

- Low-cost and stable access to capital — including investment-grade credit ratings, access to favorable bond issuance windows, and the ability to maintain liquidity and funding across market cycles.

- Efficient capital deployment — the ability to maintain strong ROIC, free cash flow conversion, and reasonable payback periods even under high CapEx conditions, while preserving pricing power and margin strength amid capacity expansion and cost inflation.

Historically, these two traits tend to reinforce each other, forming a positive feedback loop for long-term outperformance.

AI Investment: From Expansion to Return

In conclusion, we believe the AI investment narrative is steadily shifting from a “scale-first” to a “return-first” strategy. As this shift takes place, the market will increasingly differentiate between core beneficiaries—those capable of generating long-term cash flows—and peripheral players that still rely heavily on external funding and have yet to prove their business models.

While the overall AI investment approach is unlikely to change drastically in the short term, 2026 will bring heightened expectations around profitability and capital returns. In this environment, companies with lower funding costs will benefit from greater flexibility. Those that can efficiently allocate capital to scarce or clearly monetizable assets will be more likely to attract sustained market support.

Within this evolving market structure, we reaffirm that investment returns will increasingly be driven by alpha (stock selection) rather than beta (broad market exposure).

Stay tuned for Part 2, where we’ll focus on the 2026 outlook for Taiwan. 2026 Outlook Series Part 2 – Key Industry Focus: ASIC