LINE Pay Taiwan (operated by LINE Pay Corporation) is the leading mobile payment platform in Taiwan by market share. Leveraging LINE’s massive user base, it has steadily built a comprehensive ecosystem spanning payments, marketing, and financial services. In January 2024, the company was listed on the Emerging Stock Board at NT$348 per share (stock code: 7722.TW). It went public on the Taiwan Stock Exchange in July the same year, becoming Taiwan’s first listed third-party payment provider.

Business Model Breakdown

LINE Pay operates primarily through two business segments: B2B2C and B2B.

- For B2B2C, the business centers on payment services, including e-voucher issuance and sales, third-party payment services, and co-branded cards with rewards programs. The voucher business enhances store visibility and transaction activity through diverse offerings and promotions. The third-party payment service acts as an intermediary between merchants and consumers, delivering secure and seamless online/offline transactions. It also helps merchants provide user incentives to boost conversion rates. Through co-branded and reward cards in partnership with banks, LINE Pay offers one-stop financial services, increasing card promotions' effectiveness while enhancing user stickiness and satisfaction.

- For B2B, the company strengthens merchant operations via marketing and advertising services, such as acquiring potential customers for financial institutions, listing financial products for ad revenue, and providing paid ad services and customized marketing tools to partner merchants to boost exposure within the LINE ecosystem.

User Scale

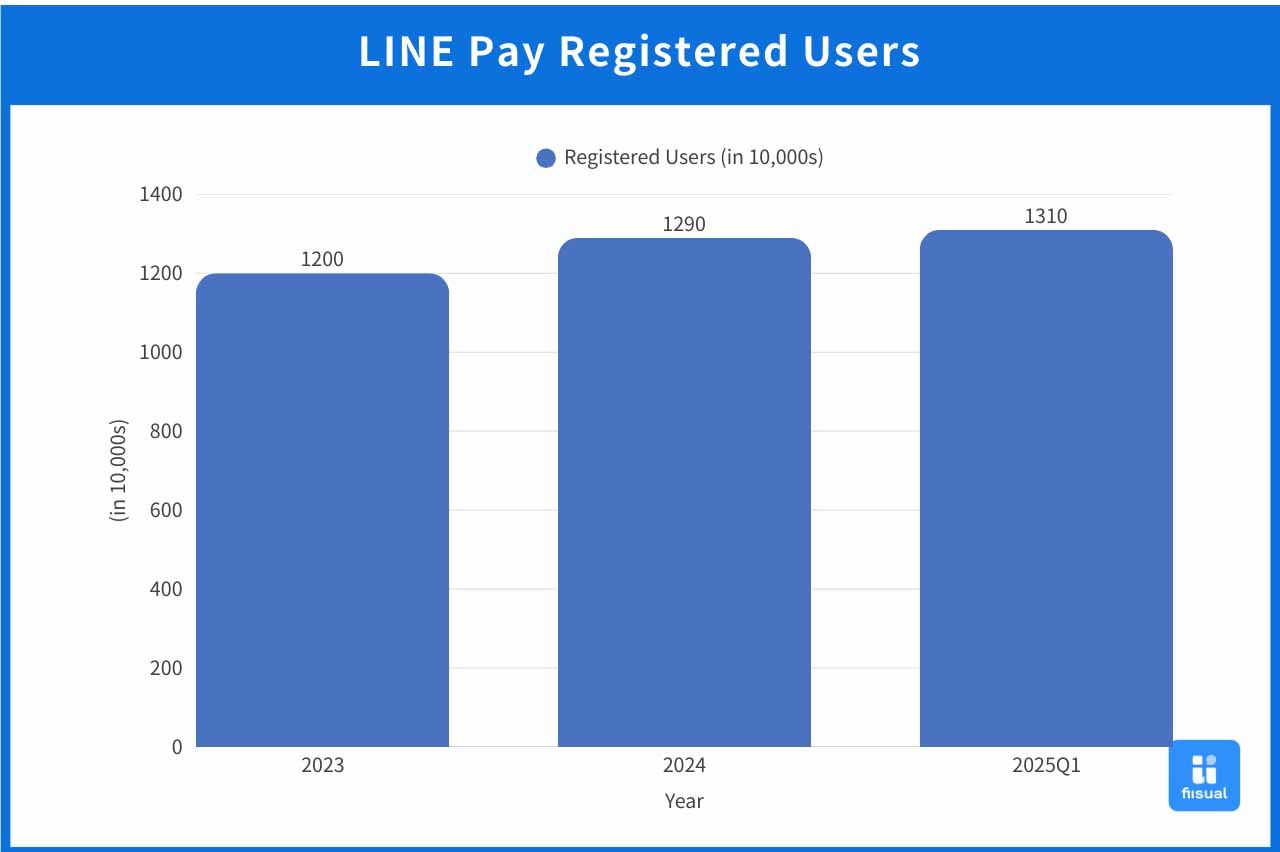

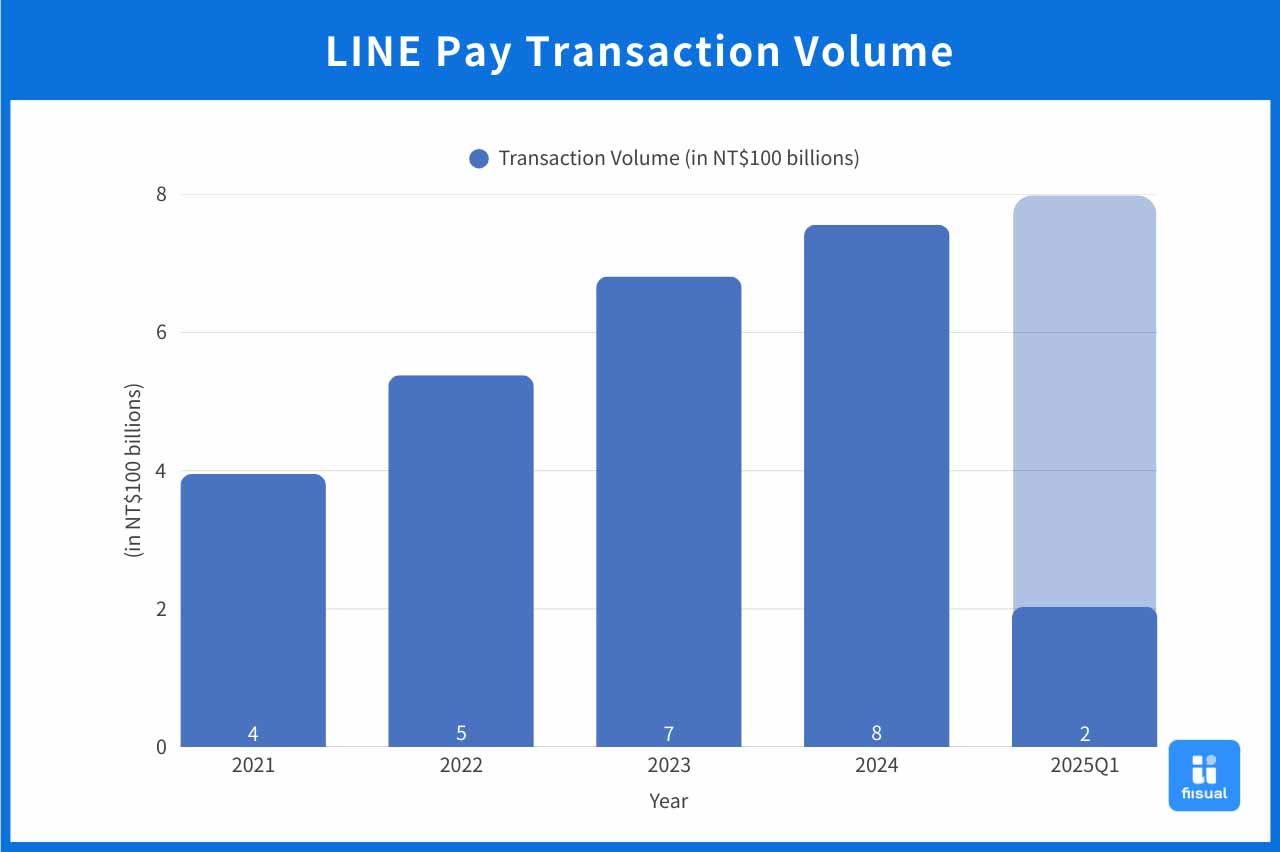

LINE Pay’s transaction volume has nearly doubled from 2021 to 2024, reaching NT$7.56 trillion in 2024. As of Q1 2025, transaction volume has reached NT$2.03 trillion. User base continues to grow, with over 13.1 million users and more than 19.5 million linked cards. There are over 610,000 payment locations across Taiwan, demonstrating LINE Pay’s deep penetration in local mobile payments and daily life services.

Recent Business Performance

Operationally, service fees remain the main revenue source in Q1 2025, accounting for 83% of total revenue. However, due to low margins, they only contribute around 52% of gross profit. By contrast, financial promotion partnerships—though only 12% of revenue—boast a 92% gross margin and contribute 36% of total gross profit. This highlights the company’s reliance on high-value financial partnerships for profitability. Most of the revenue (97.72%) comes from the Taiwan market, indicating a strong domestic focus.

| Segment | Revenue Share | Revenue Source | Description | Gross Margin | Characteristics |

|---|---|---|---|---|---|

| Service Fees | 83% | Users, Merchants, Banks | Fees from payment transactions | ~20% | High volume, low margin, core business |

| Financial Promotions | 12% | Banks | Promotions for co-branded credit/debit cards with LINE POINTS rewards | >90% | High value-added, strong ecosystem stickiness |

| System Management Services | 2% | Merchants | Revenue from system development and maintenance | ~50% | Technical services, high stickiness and stability |

Shareholding Structure

LINE Pay is under Japan's LY Corporation, which was formed from the October 1, 2023 merger of LINE Corporation and Z Holdings Corporation (Yahoo! JAPAN's parent company). Prior to the merger, SoftBank Group and South Korea’s Naver Corporation each held 50% of Z Holdings, making LY a joint venture influenced by two major Asian tech giants. This cross-border governance offers access to advanced tech and strategic vision but also introduces complexity, possibly slowing local market response.

Management Team

| Title | Name | Shares Held | Ownership % | Background |

|---|---|---|---|---|

| Chairman & CEO | 丁雄注 Dino Ting | 7,000 | 0.01% | MS, Computer Engineering, Yonsei Univ. / Former Head of Naver Pay |

| EVP, Service Mgmt. | 張修齊 Chang Hsiu-Chi | 43,875 | 0.065% | MS, Civil Engineering, NTU / Former Chairman, iPASS |

| SVP, Biz Dev | 張希雯 Chang Hsi-Wen | 60,535 | 0.089% | BS, Business Admin., National Chin-Yi Univ. / Former AVP, CTBC Bank |

| SVP, Corporate Mgmt. | 陸榮華 Lu Jung-Hua | 4,000 | 0.006% | MA, Interpretation, Hankuk Univ. / BA, Chinese, Yonsei Univ. |

| VP, Ops Mgmt. | 吳孟芝 Wu Meng-Chih | 2,141 | 0.003% | MBA, SUNY Binghamton / Former Ops Manager, Yahoo Taiwan |

| VP, Platform Planning | 詹志陽 James Chan | 37,475 | 0.055% | MS, Civil Eng., NTU / Former Consultant, PayPal Taiwan |

| VP, Development | 蘇詠順 Su Yung-Shun | 53,535 | 0.079% | MS, Civil Eng., NTU / Co-founder, Zhenyuan Tech |

| VP, Branding | 郭祝熒 Kuo Chu-Ying | 21,414 | 0.031% | MS, IP Law, NCCU / Former Sr. Marketing Manager, ASUS |

| VP, Legal | 邱慈惠 Chiu Tzu-Hui | 32,982 | 0.049% | LLM, Northwestern Univ. / Former VP, Citibank Taiwan |

| Head of Finance | 洪宇萱 Hung Yu-Hsuan | 37,475 | 0.055% | BA, Accounting, National Taipei Univ. / Former Audit Manager, Deloitte Taiwan |

| Chief InfoSec Officer | 謝佳龍 Hsieh Chia-Long | Not disclosed | Not disclosed | - |

LINE Pay Money: Latest Developments

As LINE Pay's average daily transaction volume exceeded the NT$2 billion threshold set by regulation, it was required to upgrade its e-payment license per Taiwan's Electronic Payment Institutions Act.

On July 17, 2025, Taiwan’s Financial Supervisory Commission approved LINE Pay to establish a dedicated e-payment institution—LINE Pay Money. With this license, LINE Pay Money can now offer full-fledged services such as stored value, withdrawals, peer-to-peer transfers, merchant payments, and rewards. It also unlocks premium features that were previously unavailable such as linking with 19 bank accounts, interbank transfers, and online bill payments.

On December 3, 2025, LINE Pay Money officially launched as an independent brand, replacing the former iPASS MONEY integration. It is now operated by LINE Pay’s subsidiary, LINE Pay Electronic Payment Co., Ltd. This transition marks a strategic shift, expanding service scope, enhancing financial capabilities, and laying the foundation for diversified revenue streams and higher average revenue per user.

| Feature | LINE Pay Money | iPASS MONEY |

|---|---|---|

| Operator | LINE Pay Electronic Payment (Subsidiary) | iPASS Corp. |

| Account Type | LINE Pay’s in-house e-wallet | Third-party e-wallet |

| Ecosystem Integration | Deeply integrated with LINE, LINE POINTS | Detached from LINE, back to iPASS ecosystem |

| Core Features | Top-up, withdraw, transfer, bill pay, transit code, point redemption | Top-up, withdraw, transfer, bill pay, transit fare |

| Credit Card Support | Existing LINE Pay cards auto-transferred | Requires re-binding in separate app |

| Reward System | LINE POINTS | iPASS Green Points |

| Post-2026 Usage | Fully integrated into LINE Wallet starting Dec 3, 2025 | Requires separate app download |

| Date | Event | Details |

|---|---|---|

| 2025/12/3 | LINE Pay Money goes live | Users can activate the new e-wallet in LINE Wallet; all key functions migrate to the new system |

| 2025/12/3 - 2025/12/31 | Transition Period | iPASS MONEY remains accessible for checking balances, transfers, and withdrawals only |

| From 2026/1/1 | iPASS MONEY exits LINE Wallet | LINE Wallet will only support LINE Pay Money; iPASS MONEY must be accessed via separate app |

Market Analysis & Competition

Serviceable Available Market (SAM)

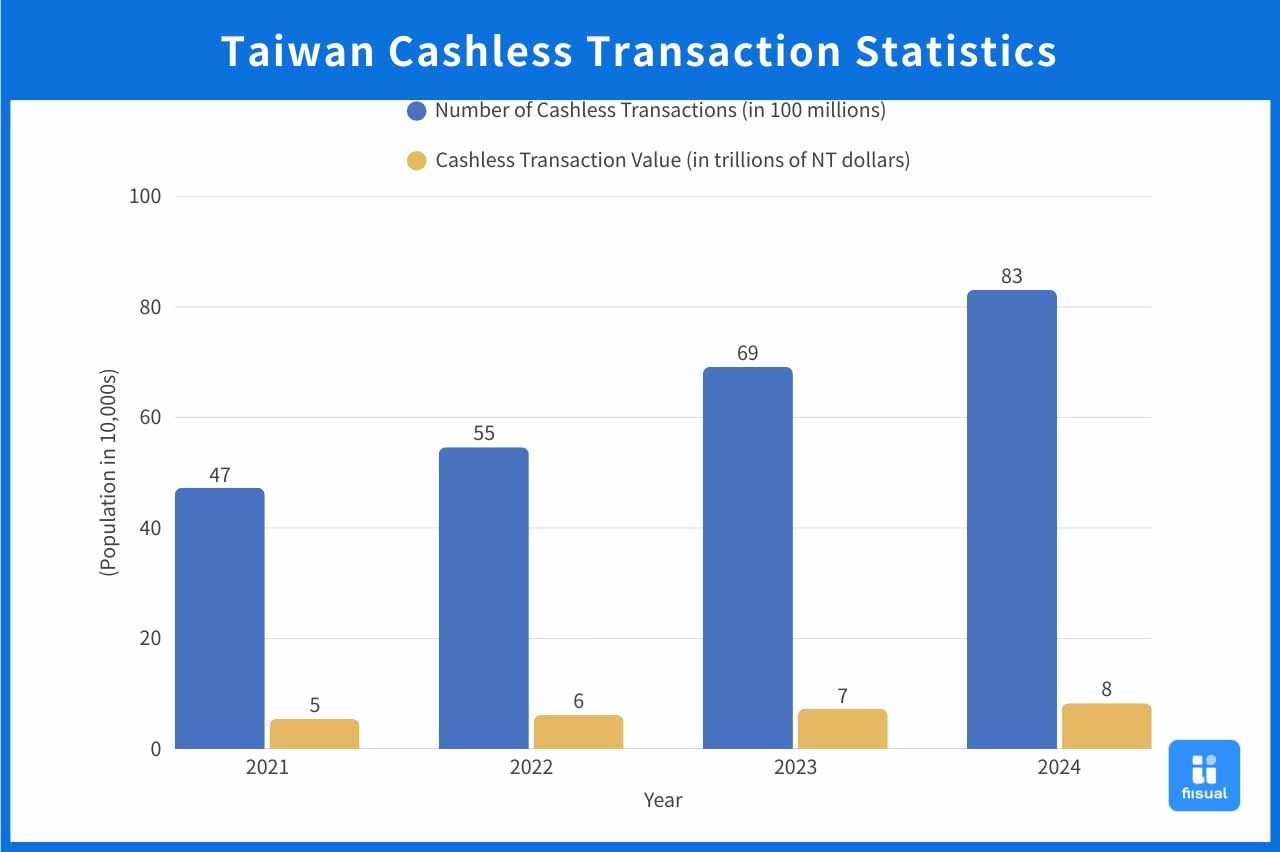

From 2021–2022, Taiwan saw strong growth in cashless payments due to the pandemic and rise of e-commerce. Growth continued into 2023–2024 as local demand rebounded and consumer habits solidified. Transaction counts surpassed the government’s 2026 target ahead of schedule, proving cashless payments have gone mainstream. Looking ahead, while transaction volumes will keep rising, monetary growth will slow due to high base effects and seasonal patterns. The government has set a 2026 goal of NT$10 trillion in non-cash payments, which will further drive industry depth.

By tool type, credit cards and ATM transfers dominate in value (over 80%), mainly for taxes, insurance, and large-ticket items, while stored-value cards and e-payments lead in frequency, especially in retail and transport. Growth drivers include higher adoption in rural areas and senior segments, cross-border e-commerce, subscriptions, fraud prevention regulations, open banking, and CBDC developments.

Share of Market (SOM)

Thanks to LINE’s 22 million monthly active users and 93% penetration in Taiwan, LINE Pay has a solid foundation of 13.1 million users and 18.3 million linked credit cards. Compared to other payment apps, LINE Pay can drive low-cost traffic through chatrooms, red packets, friend transfers, and official accounts. With point-based rewards and service crossovers (e.g., e-commerce, delivery, subscriptions), LINE Pay enhances stickiness and conversion. This positions it to maintain or even grow market share as the industry matures.

Competitive Comparison

| Feature | LINE Pay Money | JKOPay | PX Pay Plus |

|---|---|---|---|

| Operator | LINE Pay Electronic Payment Co. | JKOPay Co. | PX Pay Plus (owned by PX Mart) |

| Launch Date | Dec 3, 2025 | Since 2018 | Full service from Sep 2022 |

| User Base | Over 1M signups in 3 days; potential to convert 13.1M LINE Pay users | 6.6M in 2024; 7M by Aug 2025 (2nd largest) | 5.24M in 2024; 6.6M by Aug 2025 (fastest-growing) |

| Ecosystem | Best for social transfers, deeply tied to LINE, widest bill-pay features | Widest merchant coverage (night markets, eateries), strong cashback | Centered on PX Mart ecosystem, expanding to partners like Japan’s PayPay |

| Merchant Coverage | 610,000+ payment points | ~300,000 merchants (2024) | Core in PX Mart, exact data not disclosed |

| Rewards | LINE POINTS | JKOPoints | PX Points |

| Overseas Payments | Japan, Korea, Thailand (via LINE Pay integration) | Japan (PayPay), Korea | Japan (PayPay) |

| Target Users | LINE-heavy users, frequent small payments/transfers | Offline shoppers, youth, local small merchants | PX Mart shoppers, families, bulk buyers, point lovers |

Moat: Social Ecosystem

LINE Pay’s competitive moat is multi-layered and continues to grow with its ecosystem. Its biggest edge is LINE's messaging platform. In Taiwan, LINE has 22 million MAUs with 93% penetration. Users spend about an hour daily on the app, generating massive interactions. This allows LINE Pay to acquire users almost for free, embedding payments into social interactions such as red packets, transfers, and group chats—difficult for rivals to replicate.

Its vast user base—13.1 million users and 18.3 million linked cards—is the core of its business. The LINE POINTS system plays a key role in driving repeated use, incentivizing engagement, and increasing platform stickiness and transaction frequency.

With this user foundation, LINE Pay enjoys high traffic efficiency and low acquisition costs. This fusion of social, payment, and rewards makes LINE Pay the market leader in users, merchant count, and transaction volume, giving it a strong first-mover advantage that's hard to challenge.

Future Risks

Limited Room for Further User Growth

LINE Pay’s rapid growth was driven by user acquisition. But with over 12 million users in Taiwan, most potential users have already been onboarded. As a result, user growth may plateau as the market approaches saturation—especially with major retailers building their own payment tools.

Retail Giants Restrict Access, Crowd Out Third-Party Apps

LINE Pay’s wide market reach previously relied on retail support. But now, big players such as Uni-President (icash Pay) and PX Mart (PX Pay) are launching their own ecosystems to avoid third-party fees and deepen customer engagement, limiting LINE Pay’s access to their customer base.

Overseas Expansion Below Expectations

Despite cross-border partnerships in Korea and other regions, LINE Pay’s 2024 overseas sales and revenue share declined from 2023. This suggests slower-than-expected international growth, possibly due to local market differences, scattered marketing resources, or post-COVID shifts in spending. Without solid overseas momentum, LINE Pay remains exposed to single-market risks.