After the United States passed the stablecoin legislation known as the Genius Act, other countries have followed suit by introducing their own stablecoin-related laws. China has also shifted from its previous blanket ban to a more proactive stance, signaling interest in exploring this area. Hong Kong is set to officially implement its Stablecoin Regulation in August. So why have stablecoins become a focal point for governments around the world? Let’s take a closer look in the following article.

What Is a Stablecoin?

A stablecoin is a type of cryptocurrency that is pegged to another asset, making it more stable in value compared to typical cryptocurrencies like Bitcoin or Ethereum. Due to its price stability, it’s often used as a medium of exchange. Stablecoins can be categorized into four main types based on how they are designed:

Fiat-backed Stablecoins:

This is the most common type of stablecoin. It’s backed by fiat currencies such as the US dollar or euro. For every stablecoin issued, an equivalent amount of fiat currency must be held in reserve in a bank account. Examples: USDT, USDC.

Drawback: The issuance is limited by the fiat reserves the issuer holds, which can restrict supply.

Crypto-backed Stablecoins:

These are backed by other major cryptocurrencies like Bitcoin or Ethereum. Due to high volatility in crypto prices, they use over-collateralization to maintain stability. To mint one unit of stablecoin, the issuer must hold 1.5 to 2 times the value in crypto. Example: DAI.

Drawback: The need for over-collateralization reduces the issuer’s profitability.

Algorithmic Stablecoins:

Considered the riskiest among all types, these stablecoins aren’t backed by assets. Instead, they rely on supply-demand algorithms built into smart contracts to manage price stability. When the price deviates from its peg, the algorithm automatically issues or removes tokens. A notable example is TerraUSD (UST), which collapsed after a major sell-off led to a liquidity crisis.

Drawback: These coins require strong market trust and well-designed smart contracts—flaws can lead to collapse.

Commodity-backed Stablecoins:

These are backed by physical assets such as gold, silver, or oil. Holders can redeem the stablecoin for the underlying asset at any time. Examples: XAUT, PAXG.

Drawback: While backed by tangible assets, commodity prices such as gold can still fluctuate significantly. Demand in the crypto market may also be low, reducing liquidity.

Key Players: USDT and USDC

The stablecoin market is led by USDT and USDC, holding 62% and 24% of the market share, respectively.

USDT

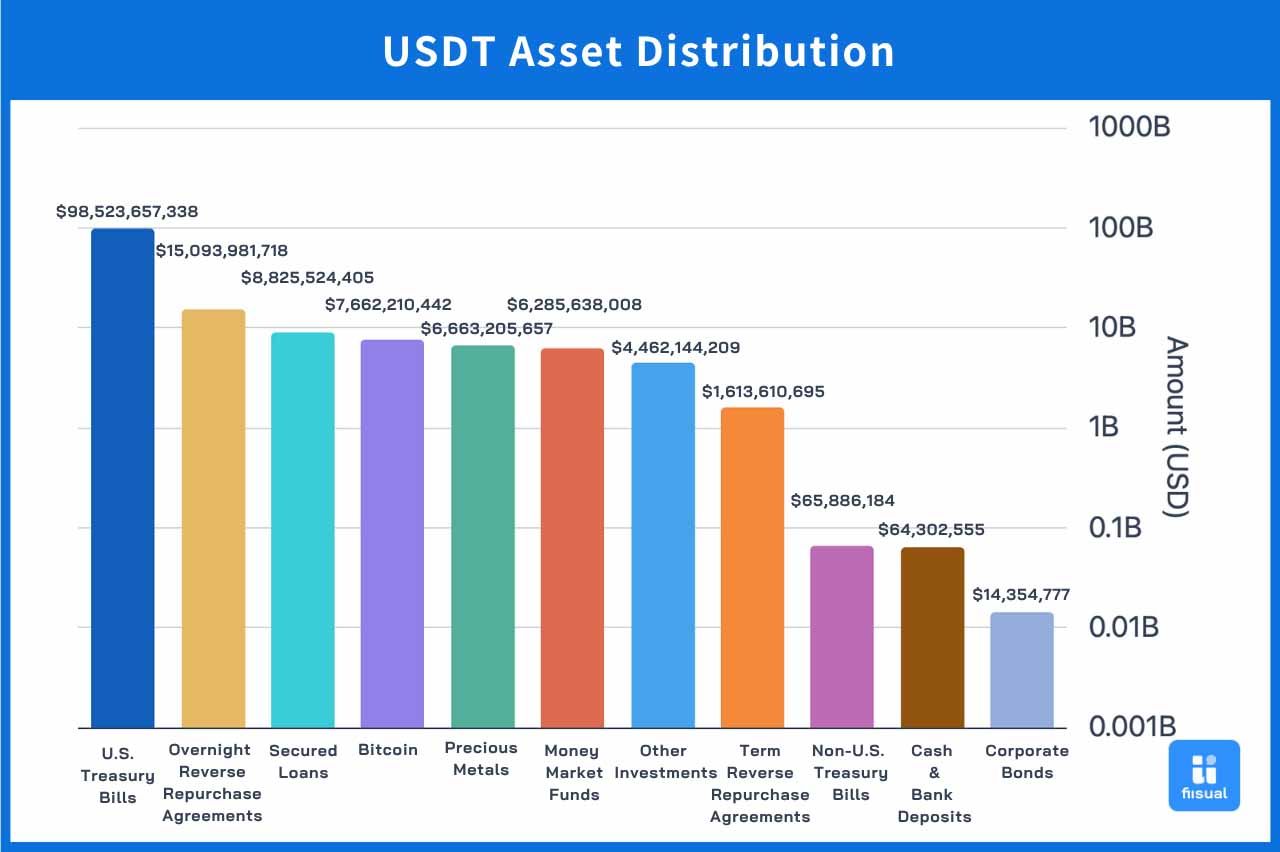

USDT was launched in 2014 by Tether, a subsidiary of iFinex, and is one of the earliest stablecoins. It’s currently the third-largest cryptocurrency by market cap, behind Bitcoin and Ethereum. Its reserves consist mostly of cash and short-term assets (about 80%), with the rest in corporate bonds, precious metals, and other risk assets such as Bitcoin. Tether publishes quarterly reserve reports.

USDC

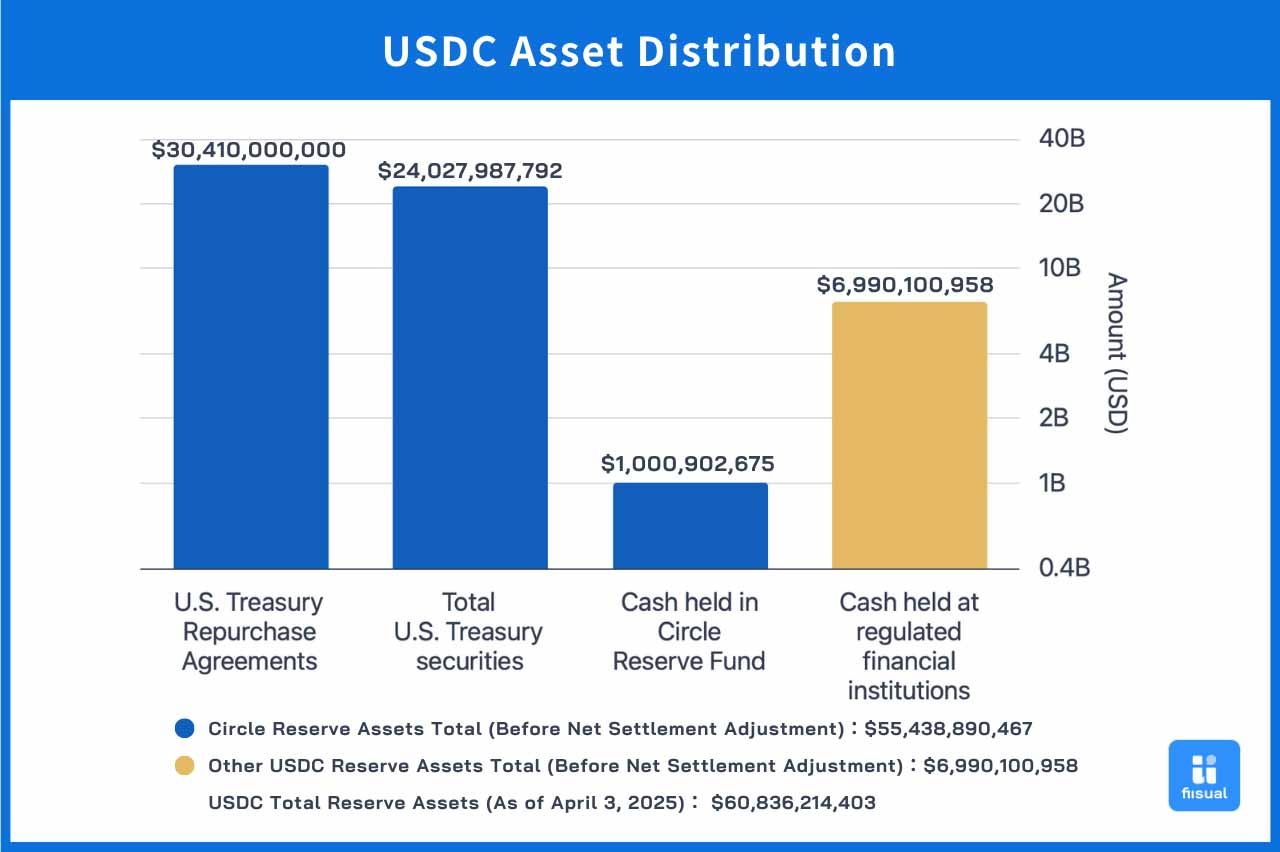

USDC was launched in 2018 by Centre, a consortium founded by Circle and Coinbase. Since 2023, Circle has taken full control of issuance. Its reserves are composed of highly liquid, low-risk assets—half in reverse repos and the rest in U.S. Treasuries and cash. Monthly reserve reports are published. USDC is favored by U.S. regulators due to its compliance and transparency.

Stablecoin Adoption and Impact

Stablecoins offer global reach and instant settlement, making them attractive to businesses. As adoption increases, traditional payment providers face pressure to adapt. To stay competitive, major payment companies are diving into stablecoin projects, using technology and strategy to expand their presence in digital payments and blockchain.

VISA

Visa (V) began settling payments with USDC over its VisaNet network in 2021. As of now, it has settled over $225 million using USDC. In September 2023, Visa enabled settlement infrastructure for acquirers like Worldpay and Nuvei, allowing them to pass USDC to merchants or convert it to fiat. Visa also partnered with stablecoin company Bridge to launch cross-border payments in Latin America and invested in BVNK, a startup building stablecoin infrastructure.

Mastercard

Mastercard (MA) announced in 2025 that it has built a stablecoin payment ecosystem. Working with Circle and Paxos, it enables payments using USDC and USDP. While blockchain-based transactions offer speed and cost benefits, user experience and regulatory compliance remain hurdles. To address this, Mastercard launched the “Mastercard Crypto Credential” service, allowing users to set up verified aliases for easier stablecoin transfers.

PayPal

PayPal (PYPL) entered the crypto space in 2020, allowing users to buy, sell, and hold crypto. In August 2023, it launched its USD stablecoin, PYUSD, becoming the first payment company to do so. In September 2024, it completed a B2B transaction using PYUSD to pay a multinational accounting firm, showcasing stablecoin use in business payments. In April this year, PayPal announced that U.S. users can earn an annualized yield of 3.7% by holding PYUSD in PayPal or Venmo wallets, boosting its appeal.

Retail Sector

Retailers are also exploring issuing their own stablecoins. With real-time settlement capabilities, stablecoins can solve common delays in cross-border payments and help cut down transaction fees. Traditional card processing fees range from 1.5% to 3.5%, whereas stablecoin payments on networks like Solana cost only around $0.00025 per transaction. This could save retailers billions annually and reduce reliance on platforms like Visa and Mastercard.