Price Trend Summary

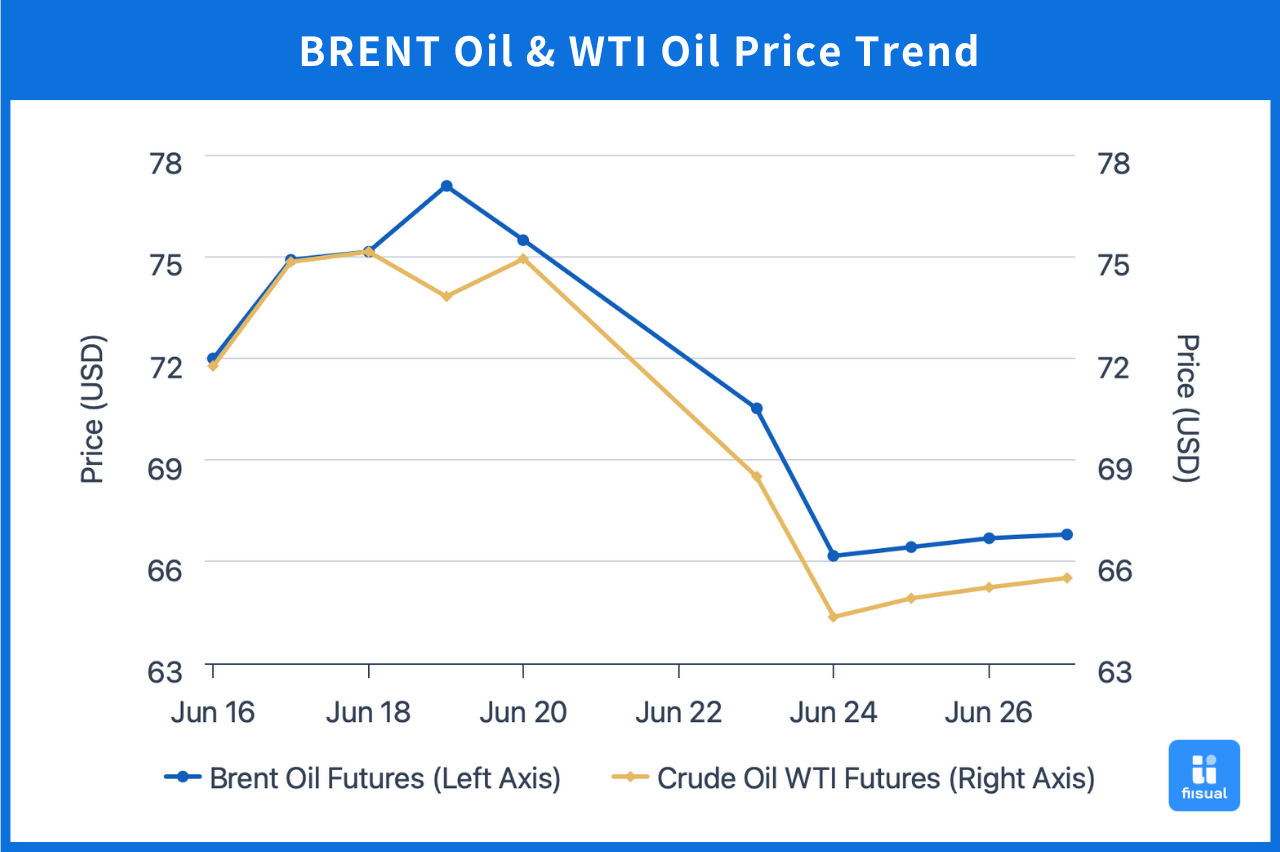

| Opening (6/16) | Closing (6/27) | Price Change | |

|---|---|---|---|

| Brent Crude | 78.31 | 66.80 | -14.7% |

| WTI Crude | 76.54 | 65.52 | -14.4% |

| Dubai Crude | 69.34 | 69.19 | -0.2% |

In the first week, the market opened higher due to concerns over escalating tensions in the Middle East. However, as Iran signaled a willingness to cease fire and the G7 echoed calls for de-escalation, expectations of conflict expansion faded rapidly, and oil prices retreated from their highs. In the mid-week, with no concrete easing in Israel-Iran tensions and U.S. policy stance remaining unclear, market participants turned cautious, leading to range-bound trading and an overall weekly decline of around 2%.

In the second week, oil prices gapped up at the open after Iran’s parliament passed a bill to close the Strait of Hormuz during the weekend, raising fears of supply disruptions. But following U.S. mediation, a ceasefire was reached between Israel and Iran, and the geopolitical risk premium swiftly unwound, causing a steep price drop. Later in the week, although the EIA reported stronger-than-expected inventory draws and both China and the U.S. signaled progress in trade talks, oil prices lacked rebound momentum and ended the week down by approximately 15%.

Crude Oil Data Update

Crude Inventories Remain Low; Product Drawdowns Continue Despite Weak Upstream Investment Appetite

| 6/25/25 | 6/18/25 | 6/11/25 | |

|---|---|---|---|

| Inventories (Million Barrels) | |||

| Commercial Crude (Excluding SPR) | 415.1 (-4.8) | 420.9 (-11.5) | 432.4 |

| Strategic Petroleum Reserve (SPR) | 402.5 (+0.2) | 402.3 (+0.2) | 402.1 |

| Motor Gasoline | 227.9 (-2.1) | 230.0 (+0.2) | 229.8 |

| Distillates | 105.3 (-4.1) | 109.4 (+0.5) | 108.9 |

| Production Activity | |||

| Rig Count | 438 (-1) | 439 (-3) | 442 |

| Refinery Utilization Rate (%) | 94.7 (+1.5) | 93.2 (-1.1) | 94.3 |

Commercial crude inventories continued to trend downward over the past two weeks, falling by a cumulative 16.3 million barrels—well above market expectations. SPR saw a modest increase of 400,000 barrels, with the pace of refill slowing and the White House indicating no immediate plan to replenish. On the product side, gasoline and distillate stocks both declined—by 1.9 million and 3.6 million barrels respectively—reflecting robust end-user demand and easing prior concerns over a weak driving season. On the supply side, the active rig count dropped by 4 units, suggesting a potential slowdown in shale output over the coming months. Meanwhile, refinery utilization edged up by 0.4 percentage points, showing that refiners are actively stocking up in response to peak seasonal demand.

Geopolitical Developments

Israel-Iran Ceasefire Agreement

At 6:02 PM EDT on June 23, U.S. President Donald Trump announced via social media platform Truth Social that Israel and Iran had reached a ceasefire agreement, set to take effect on June 25. The market reacted swiftly, with Brent crude futures plunging from $78 to $66 per barrel—slightly below pre-conflict levels. As of now, no further military confrontations have occurred, but the short-term outlook remains uncertain and warrants close monitoring.

Observations from the options market show a significant drop in implied volatility after the ceasefire announcement. This reflects traders' expectations for reduced future price swings and a decreased willingness to pay high premiums for hedging. The flattening of the volatility term structure also indicates waning short-term trading enthusiasm.

Commentary

Although the Israel-Iran conflict has temporarily subsided, Iran has stated that it has no plans to resume nuclear negotiations in the near term. Coupled with the ongoing Russia-Ukraine war, geopolitical risks will continue to offer short-term support to oil prices. On the fundamentals side, U.S. crude inventories have posted significant declines for five consecutive weeks, while the active rig count has dropped to the lowest level since October 2021—pointing to a potential slowdown in shale oil supply. If demand remains steady, further inventory drawdowns could support oil prices. We expect oil prices to remain range-bound leading up to the early-July OPEC internal meeting, with key focuses on U.S. tariff negotiations, geopolitical developments, and OPEC policy direction.

Summary

As geopolitical risks recede, the market is expected to shift back toward fundamentals-based pricing. Whether U.S. supply tightens and whether OPEC continues its production policy in the upcoming July meeting will be central to market direction. Moreover, with the reciprocal tariff deadline approaching, successful trade negotiations between the U.S. and major economies could provide short-term upside for oil prices.